From Brick to Click

Industry Breakdown: Commercial Real Estate AI

Welcome to Autopilot's Industry Breakdown Series. Here, we explore and analyze how AI is reshaping different sectors of our economy. If you’re passionate about understanding the forces driving the future, you’re in the right place. In this review, we dive into the commercial real estate industry and its latest applications of AI.

I. Background

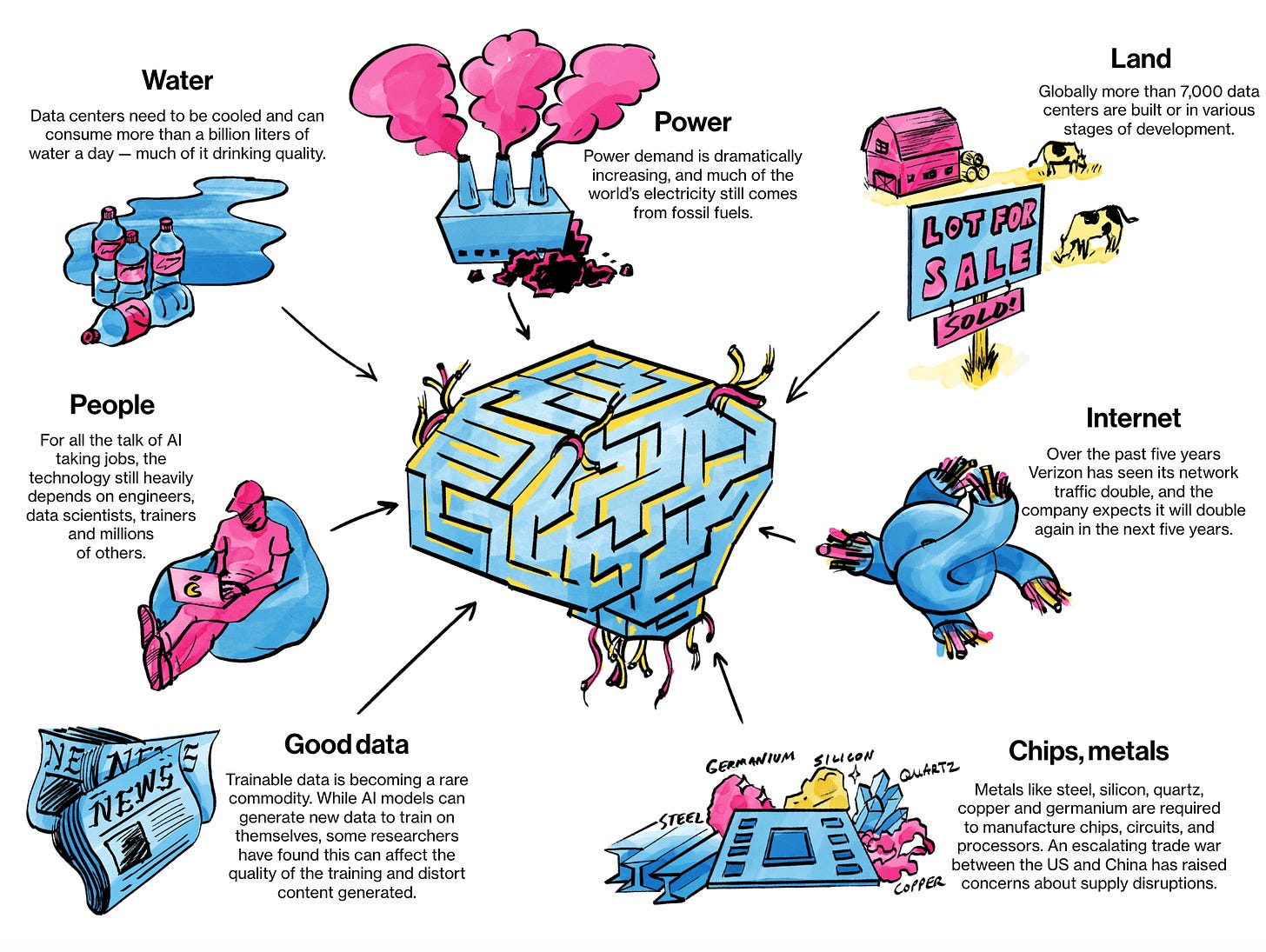

Economic theory defines the four fundamental factors of production as land, labor, capital, and entrepreneurship. While some argue that these principles are outdated in the digital age, where anyone can launch a company from their home - this view overlooks a critical reality: every digital innovation still depends on physical resources. The materials and labor used to manufacture your computer, the electricity powering each Google search or ChatGPT query, and the computing infrastructure housed within one of the 7,000 data centers worldwide - all of these exist on physical land.

Nearly every aspect of our existence and economic activity takes place on some parcel of land. It provides the resources we consume, the spaces we inhabit, and the infrastructure that drives global commerce. Yet, despite its foundational role in the economy, real estate has been one of the slowest sectors to embrace technological transformation. Until now.

This report examines the state of AI in the commercial real estate (CRE) industry in the US, with a focus on development, management, and investment. We will not cover AI in lending, construction, or architecture in depth, as these topics deserve separate, dedicated reports.

Who Should Read This Report?

Technology professionals interested in the business of real estate will find the most value in The Need and The Market sections.

Real estate professionals looking to enhance their firm’s operations will benefit most from The Technology and The Innovators sections.

For the curious, we encourage a full read-through for a live, up-to-date picture of AI’s impact on commercial real estate.

Contents

I. Background

Overview of Real Estate in the US

Zoning as a Framework for Understanding Real Estate

The Datafication of Real Estate

Introduction to the Innovators

II. The Need

Development Cycle

Developer Zoom-In

Property Manager Zoom-In

Investor Zoom-In

III. The Technology

The Real Estate Tech Stack

Build vs Buy

Solution Compass

Opportunities for Startups

IV. The Market

Industry Adoption Trends

Partnerships

Pricing and Demand Drivers

Labor Market Size

Further Reading & Industry Voices

For those looking to stay informed on AI and real estate, these sources provide valuable insights:

Thesis Driven – Cutting-edge analysis on the future of the built world.

The Real Deal – In-depth reporting on commercial real estate trends and emerging technologies.

Fifth Wall – Leading venture capital firm investing at the intersection of real estate and tech.

Alpaca VC – Research-powered venture capital firm investing into real estate and commerce.

Overview of Real Estate in the US

Real estate is the largest asset class in the United States, with its total value exceeding $90 trillion in 2024, surpassing the stock market and fixed-income securities combined. Every company, institution, and household relies on physical space for operations, commerce, and living. The real estate sector underpins the financial system, employment market, and investment portfolios of both institutional and individual investors.

The market can be broadly categorized into three primary segments:

📌 Residential Real Estate – $59.774 trillion

📌 Commercial Real Estate – $21.828 trillion

📌 Farmland – $3.515 trillion

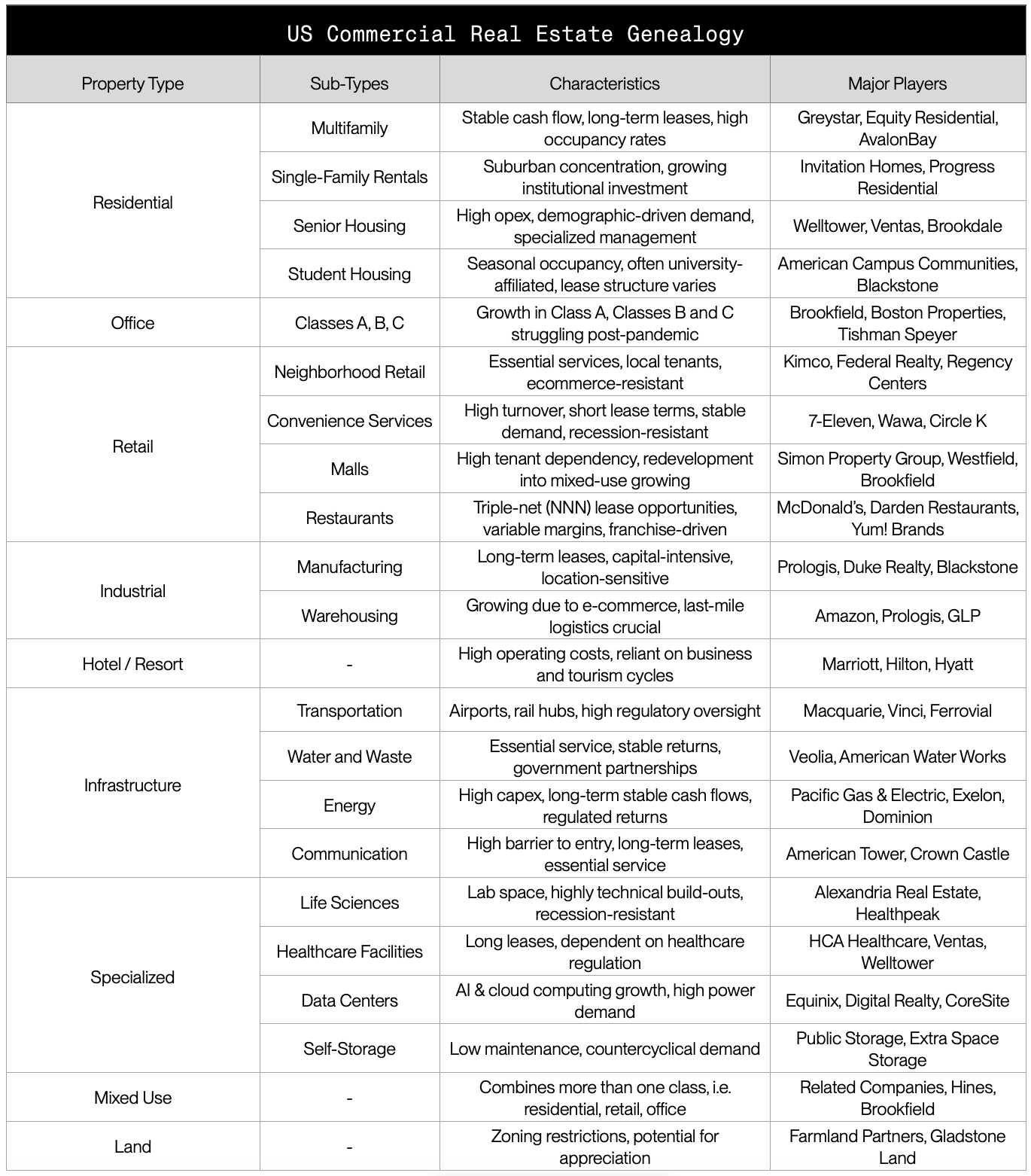

CRE Assets Classes

Commercial real estate functions as both an operating business and an investment class. Institutional investors, including REITs (Real Estate Investment Trusts), private equity firms, pension funds, and sovereign wealth funds, play a dominant role in buying, developing, and managing these assets.

Property Valuation & Cap Rates

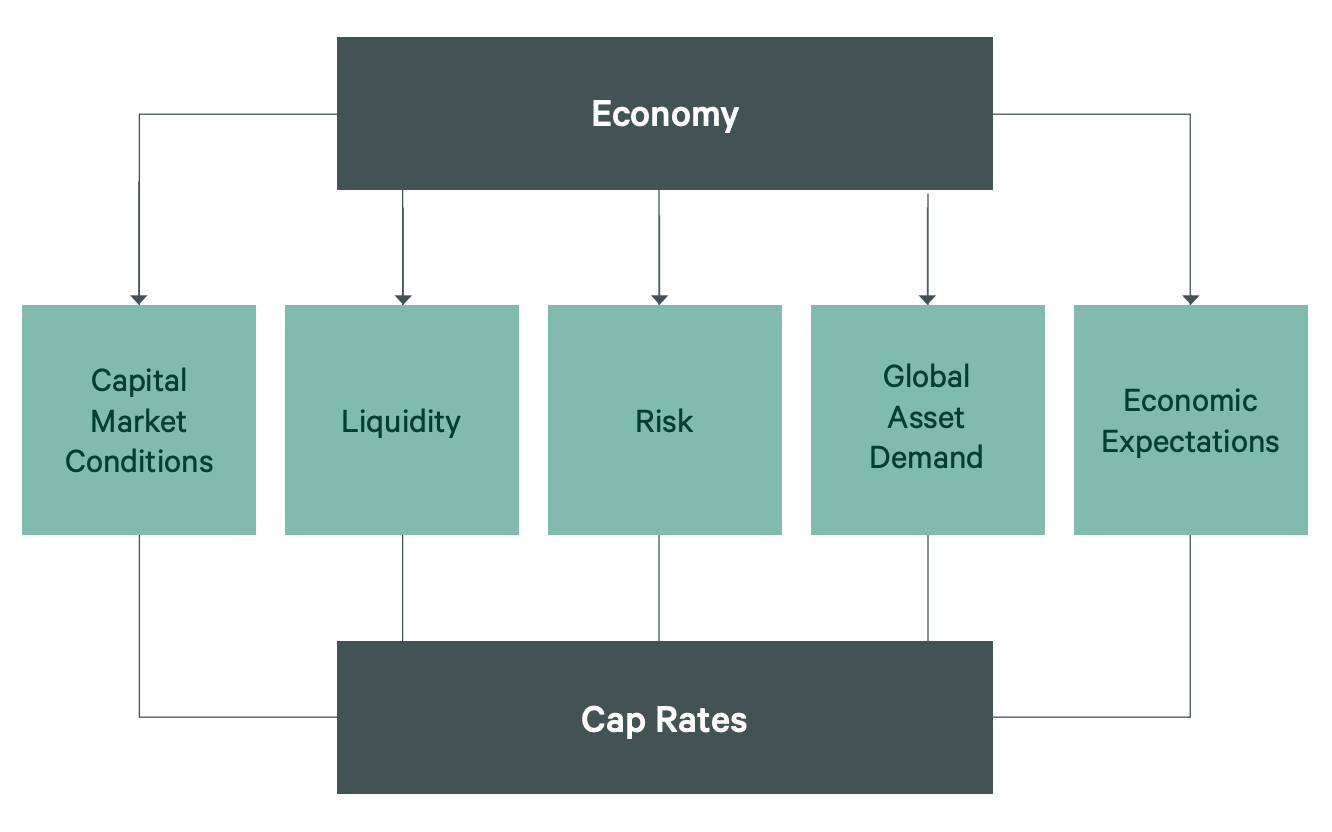

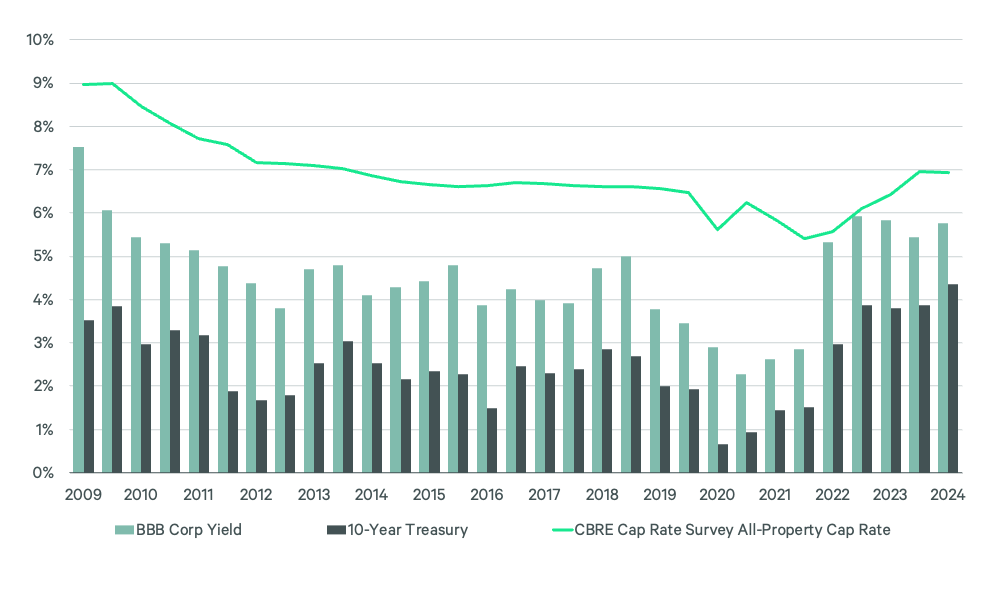

In commercial real estate, property valuation is determined using the capitalization rate (cap rate) - the ratio of a property’s net operating income (NOI) to its purchase price. It is influenced by the risk-free rate of return plus a premium based on factors such as asset type, location, tenant stability, and market conditions.

For example, if a property generates $1 million in annual NOI and the prevailing cap rate for similar properties is 6%, its estimated value would be $16,670,000 (1,000,000 / 6%). This suggests that at a 6% cap rate, an investor purchasing the property for $16.67 million would expect a 6% annual return on investment from net income alone.

Cap rates tend to compress when interest rates are low and investor demand is high, leading to higher valuations. Vice-versa, they expand when interest rates rise or market uncertainty grows, resulting in lower property values. When underwriting a real estate deal, the exit cap rate is one of the most important, and also the least predictable assumptions an investor makes.

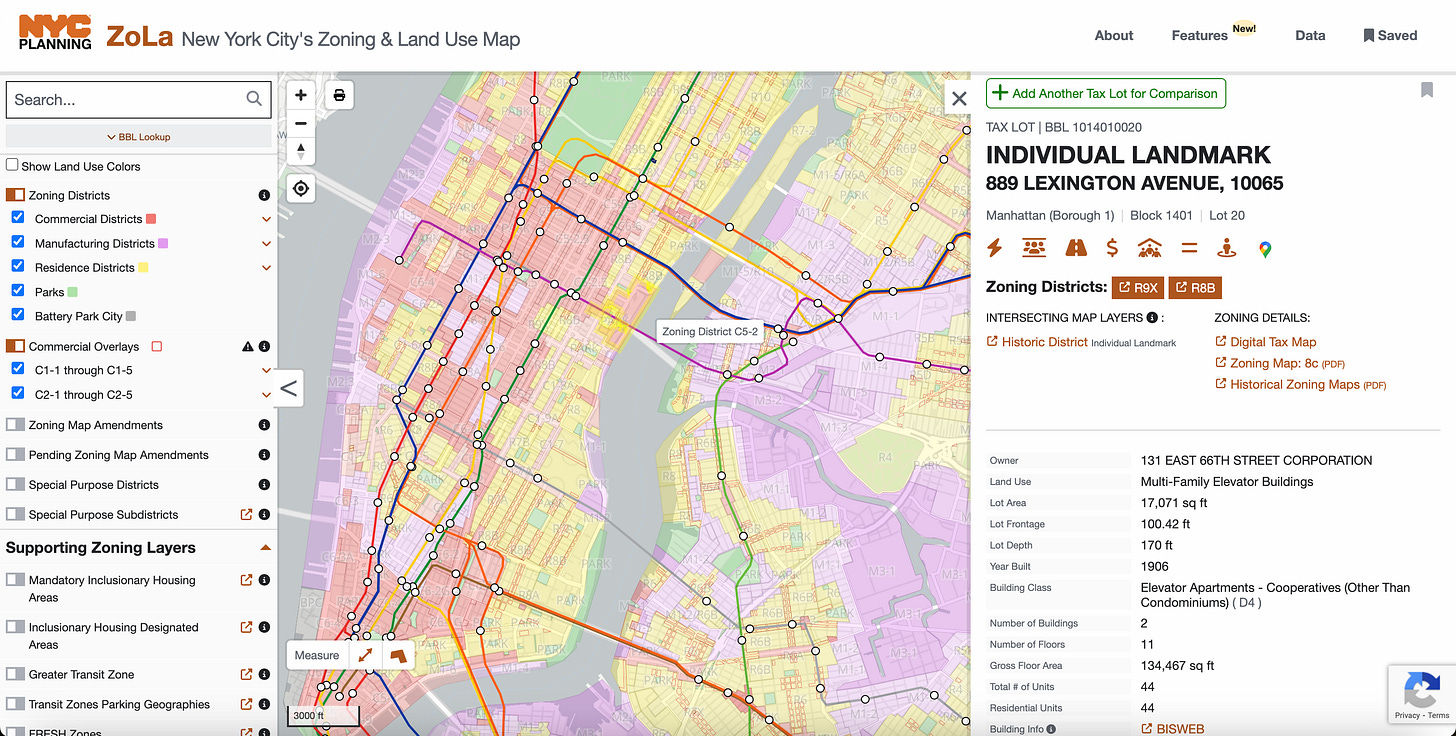

Zoning as a Framework for Understanding Real Estate

Zoning is the legal framework that dictates what can be built, where, and how. Zoning laws govern land use, dividing areas into different categories such as:

📌 Residential (R) – Single-family homes, multifamily apartments

📌 Commercial (C) – Retail stores, office buildings

📌 Industrial (I) – Warehouses, manufacturing hubs

📌 Mixed-Use (MU) – Developments that combine residential, commercial, and public spaces

Municipalities create districts and neighborhoods based on a master plan to manage growth, traffic, noise, and resource allocation. Local governments use zoning to separate commercial and residential activities, preventing businesses from operating in designated housing areas. However, these restrictions can lead to conflicts between property owners and municipalities. Beyond land use, zoning also regulates building specifications, such as height restrictions, density limits, and setback requirements. For example, high-rise buildings may be prohibited in certain areas, even if they comply with general construction codes.

The Datafication of Real Estate

From Fragmented to Institutional

For much of history, real estate was a localized and fragmented industry, dominated by individual landlords, family-owned businesses, and the government. Property transactions relied heavily on personal relationships, regional expertise, and informal deal-making, creating a market that was inefficient, opaque, and difficult to scale.

This changed over the past few decades as institutional investors began acquiring large portfolios of assets. These firms brought capital at scale and operational efficiency, leading to the professionalization and financialization of real estate. One of the most dramatic shifts has occurred in multifamily housing. In 1990, institutional investors owned just 5% of multifamily rental properties in major U.S. cities. Today, that figure exceeds 40%, with firms like Blackstone, Starwood, and Greystar controlling massive residential portfolios.

The trend extends across office, industrial, and retail properties, where institutions have deployed billions into stabilized assets, value-add projects, and development deals. This shift has transformed real estate from a fragmented industry into a structured, global asset class, making it more accessible to large investors.

The Data Explosion in Real Estate Investment

Investors needed accurate, standardized market intelligence to deploy capital efficiently across portfolios. Real estate data was difficult to access, unstructured, and controlled by brokers and private firms. Investors relied on internal research, local agents, and scattered public records, creating inefficiencies in valuations, leasing decisions, and market analysis.

CoStar launched in 1987 and changed this by systematically collecting, verifying, and distributing CRE data at scale. This data moat turned CoStar into ‘the Bloomberg Terminal’ of real estate investing, leveling the playing field for those without deep local networks. However, real estate data remains far from open. Unlike stocks or commodities, where pricing composition is transparent, investment firms see proprietary data as a key competitive advantage. While CoStar improved market transparency, it also reinforced a paywalled approach to real estate data.

Today, the amount of data available to real estate investors and operators is unprecedented. Satellite imagery, IoT-enabled buildings, tenant behavior tracking, and alternative datasets (e.g., cell phone movement patterns, Google search trends, and Yelp reviews) are increasingly used to refine site selection, underwriting, and asset management.

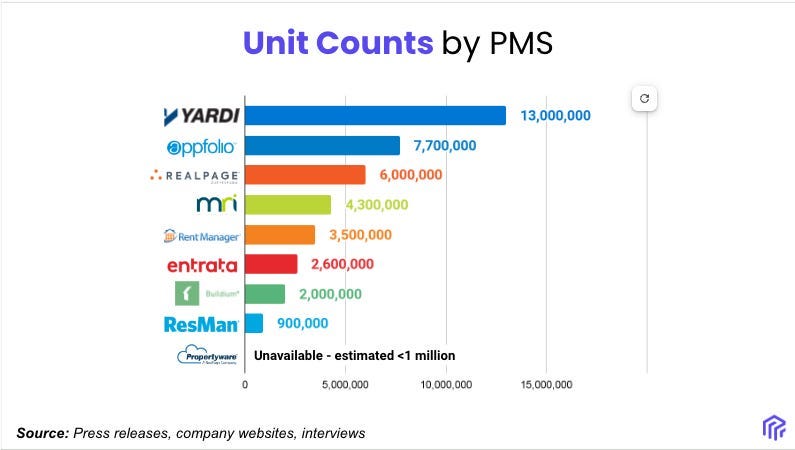

The Rise of Proptech & AI’s Role in the Next Evolution

Before real estate firms embraced technology, property management was highly fragmented. Leases were tracked in diaries, maintenance requests handled through paperwork, and financials processed manually. Proptech’s first real breakthrough came not from disruption, but from centralization. Property management systems (PMS) like Yardi, MRI, RealPage, AppFolio, and Entrata consolidated leasing, accounting, maintenance, and tenant communications into a single platform. Yet, no single PMS could address every need, especially from a user experience perspective, leading to the rise of specialized point solutions. These solutions integrate with PMS platforms but also compete with them, creating a push-pull dynamic between deeply entrenched incumbents and new entrants.

The next phase of real estate technology is being shaped by AI, embedding intelligence directly into investment and operational workflows. The question is no longer whether PMS will evolve, but who will control the data, the workflow, and ultimately, the real estate business itself.

AI-First Real Estate Investors & Developers: The Next Frontier

For decades, the world’s largest real estate services firms - CBRE, JLL, and Cushman & Wakefield - have played a central role in commercial real estate, acting as intermediaries between investors, developers, and tenants. These firms not only manage vast portfolios but also shape how technology is adopted across the industry. Recognizing the growing importance of data and automation, they have built dedicated technology divisions.

Yet, while CBRE and JLL are layering AI into their existing operations, a new category of AI-first owner-operators is emerging - companies designed from the ground up with technology at the core of their investment and management strategy. Firms like Groma and Alpaca Real Estate represent the next evolution of property investment.

As AI adoption accelerates, the divide between legacy firms retrofitting technology and new entrants built around AI from the start will become more pronounced. The future of real estate will not be about whether AI is adopted - it already is. The real question is who will integrate it most effectively and at what scale?

Introduction to the Innovators

In our research, we analyzed over 100 companies, including emerging proptech startups and industry giants like Appfolio and Realpage, which have expanded their AI capabilities through acquisitions and in-house development. From AI-powered underwriting to autonomous leasing assistants and predictive maintenance systems, these companies are redefining how real estate is managed and transacted.

II. The Need

Commercial real estate is a complex, slow-moving industry with long development timelines, fragmented operations, and heavy reliance on manual processes. Projects involve multiple stakeholders - governments, developers, lenders, contractors, property managers, and investors. Each of these groups have different priorities, creating inefficiencies at every stage.

Despite institutional capital increasing the scale of ownership, decision-making remains slow, workflows are disjointed, and data is often siloed or outdated. Permitting takes years, construction faces delays and cost overruns, leasing decisions lack real-time market intelligence, and property management is still labor-intensive. Understanding these bottlenecks clarifies where AI and automation can streamline operations, cut costs, and improve decision-making across the industry.

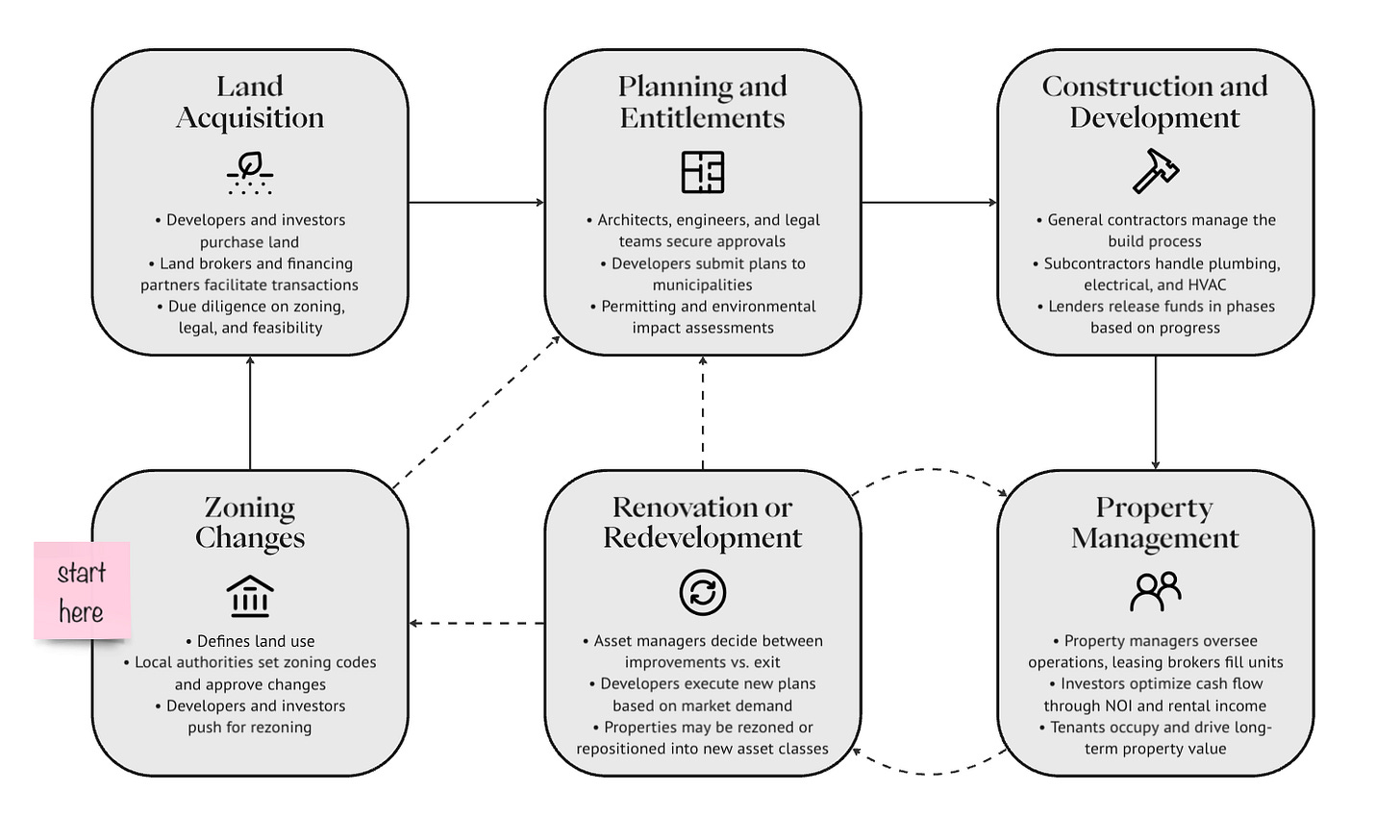

Development Cycle

The real estate development cycle is a structured process that transforms raw land into income-generating properties. This cycle involves multiple stakeholders - governments, developers, lenders, contractors, property managers, and tenants, each playing a critical role in shaping the built environment.

i. Zoning Changes

Before any development begins, local governments dictate how land can be used. Municipal zoning laws define what can be built (residential, commercial, industrial, mixed-use), density restrictions, height limits, and other regulations. Governments may also rezone areas to encourage new development, incentivizing projects through tax credits, subsidies, or streamlined approval processes.

Key Players

📌 Governments – Regulate land use, approve zoning changes, and set incentives.

📌 Urban Planners – Shape zoning codes and city growth plans.

📌 Community Stakeholders – Influence rezoning decisions through advocacy or opposition.

ii. Land Acquisition

Once zoning is established, developers and investors compete for prime land parcels. Land acquisition is a high-risk, high-reward phase - securing the right site at the right price is essential for a project’s success. Financing plays a major role here, as large-scale developments often require significant capital before generating any returns.

Key Players

📌 Developers – Identify land parcels, assess feasibility, and secure financing.

📌 Investors – Purchase land for future appreciation or development.

📌 Lenders – Provide acquisition financing through debt or structured loans.

📌 Land Brokers – Facilitate transactions between buyers and sellers.

iii. Planning & Entitlements

The planning phase involves obtaining entitlements (permits, zoning approvals, environmental clearances) and designing the property. This is a bureaucratic bottleneck in many markets, as regulatory approvals can take years, significantly impacting project timelines.

Key Players

📌 Developers – Ensure the project meets financial and regulatory requirements.

📌 AEC – Design the property, balancing aesthetics, functionality, and compliance.

📌 Governments – Review and approve project plans, conduct impact assessments.

📌 Legal Teams – Navigate land use laws

iv. Construction & Development

Once permits are secured, construction begins. This phase involves large capital outlays, making cost overruns and delays major risks. Developers often engage general contractors (GC’s) to manage construction, while subcontractors handle specialized tasks like electrical, plumbing, and HVAC.

Key Players:

📌 GC’s – Manage overall construction, hiring subcontractors.

📌 Subcontractors – Execute specialized work (plumbing, electrical, HVAC, etc).

📌 Suppliers & Logistics – Provide raw materials and ensure timely delivery.

📌 Lenders – Disburse construction loans in phases based on project milestones.

v. Property Management

Once a property is built, it must be leased, sold, or managed to generate returns. Investors focus on occupancy rates, rental income, and asset appreciation to achieve desired returns.

Key Players:

📌 Property Managers – Oversee operations, tenant relations, and maintenance.

📌 Leasing Brokers – Market and lease vacant units to tenants.

📌 Real Estate Agents – Facilitate property sales for developers and investors.

📌 Tenants & Occupants – End-users who lease or purchase space.

vi. Renovation or Redevelopment

As market conditions shift, properties require renovations or full-scale redevelopments to remain competitive. Investors evaluate whether modernizing an existing asset or repurposing it entirely will yield stronger returns.

Key Players:

📌 Investors – Identify value-add opportunities for renovations.

📌 Developers – Execute redevelopment plans based on market demand.

📌 Capital Providers – Finance renovation projects through equity or loans.

📌 Government – Approve redevelopment plans and zoning modifications.

While real estate development follows a structured cycle, roles often overlap. Many firms vertically integrate to capture more value - for instance, Blackstone develops, owns, and manages assets in-house, reducing reliance on third parties. Similarly, some developers become property managers to retain control over their buildings, while most institutional investors hire property managers but maintain asset oversight.

This interplay between development, investment, and operations underscores the complexity of real estate. The next sections will break down how developers, property managers, and investors structure their businesses, manage workflows, and navigate inefficiencies in the industry.

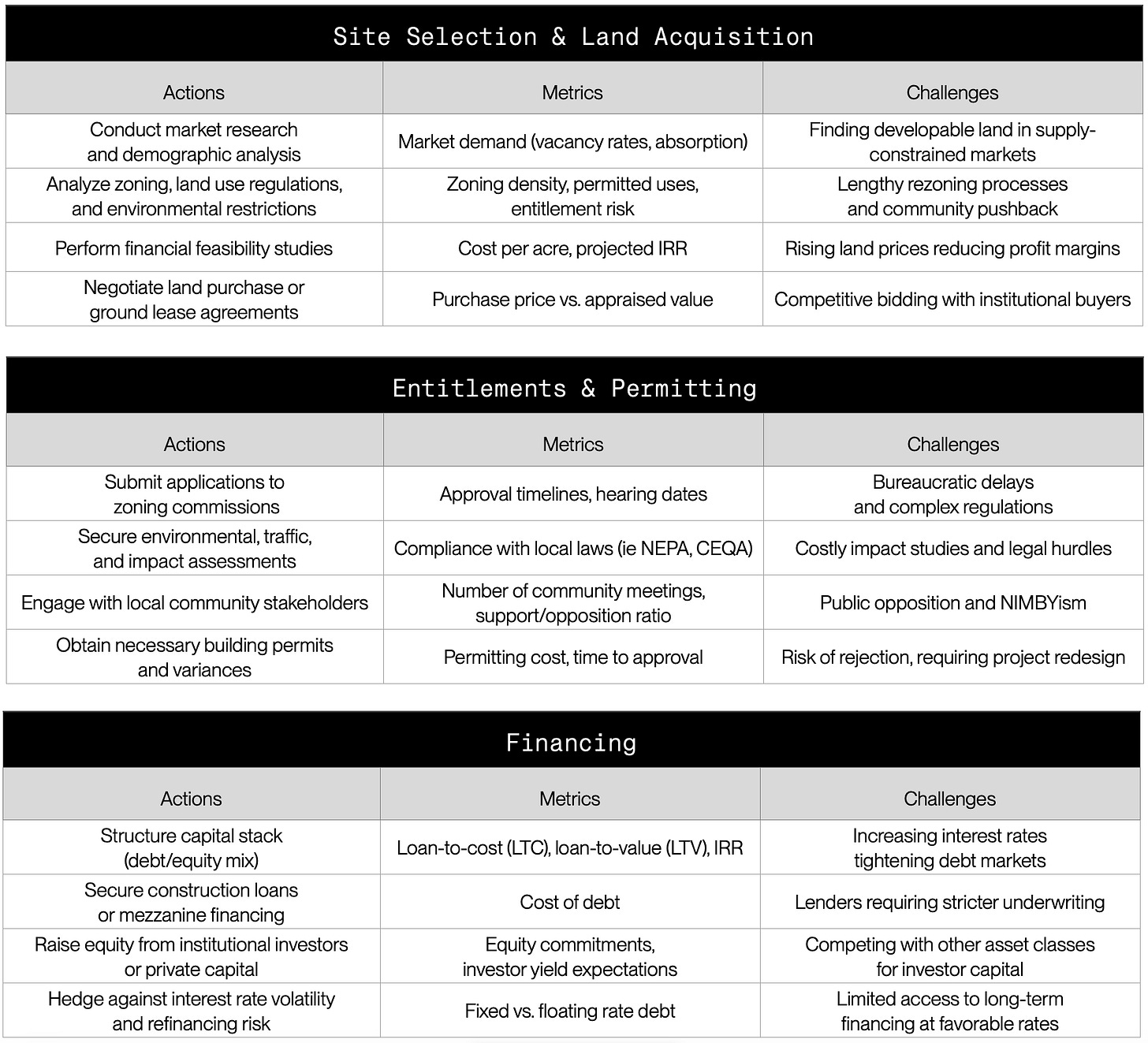

Developer Zoom-In

Real estate developers are the primary drivers behind new property construction, overseeing projects from land acquisition to project completion and stabilization. They operate at the intersection of capital, construction, and market demand, coordinating efforts between investors, contractors, government agencies, and end-users to bring projects to life.

Most development firms follow a hierarchical structure with specialized divisions for land acquisition, entitlements, construction management, finance, and asset disposition. Larger firms tend to integrate investment and property management functions, while smaller developers often partner with third-party managers or financiers.

The key business drivers for developers include:

Market Demand: Identifying profitable opportunities based on economic trends and tenant needs.

Financing & Capital Markets: Managing debt, equity, and investor expectations.

Government Approvals: Securing entitlements, zoning changes, and permits.

Construction Costs & Timelines: Controlling expenses and delivering projects on schedule.

Exit Strategy: Selling or leasing properties for maximum returns.

Developers must balance risk and reward, as real estate projects require high upfront capital investments with long payback periods and exposure to economic cycles.

Workflows

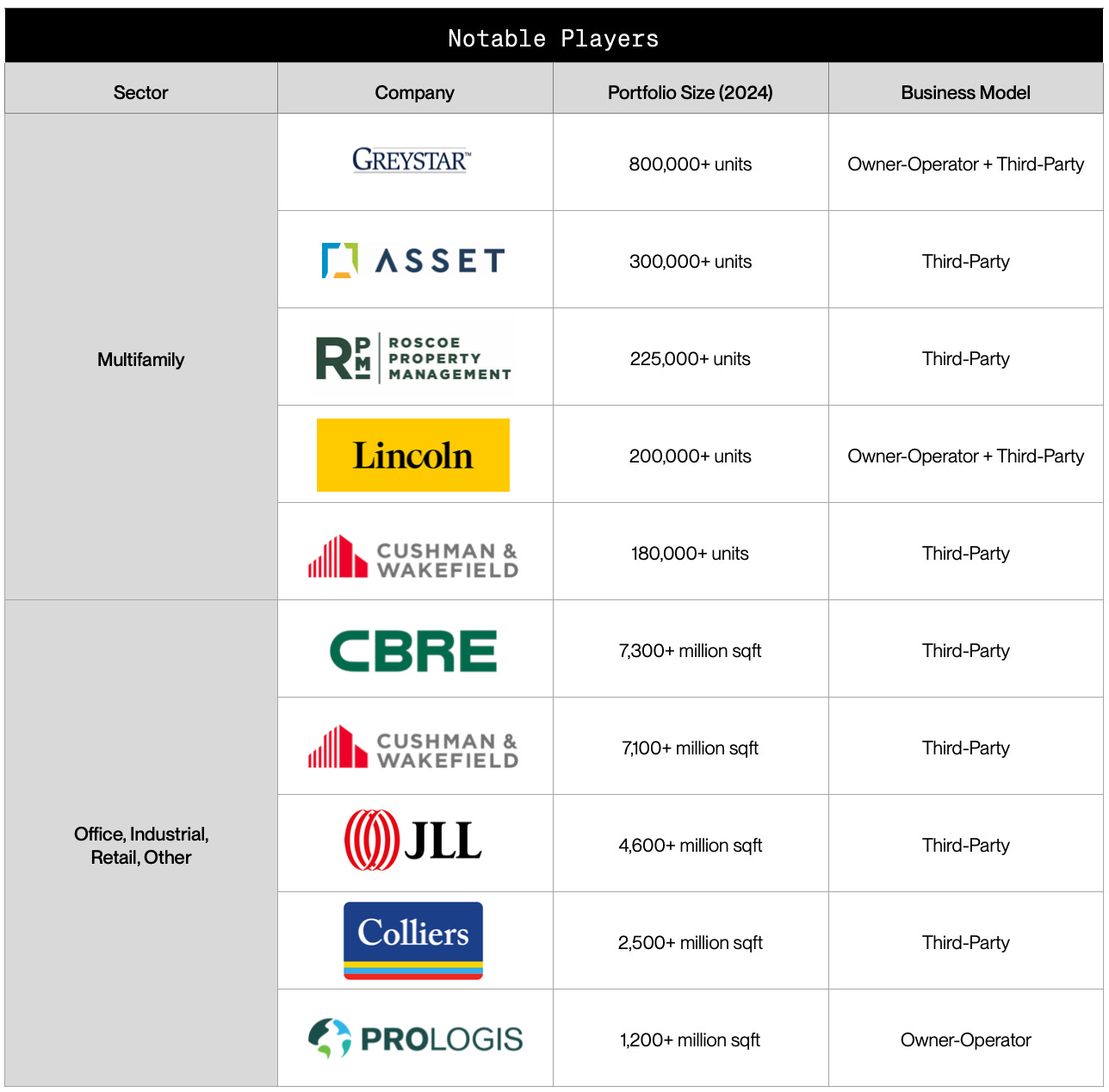

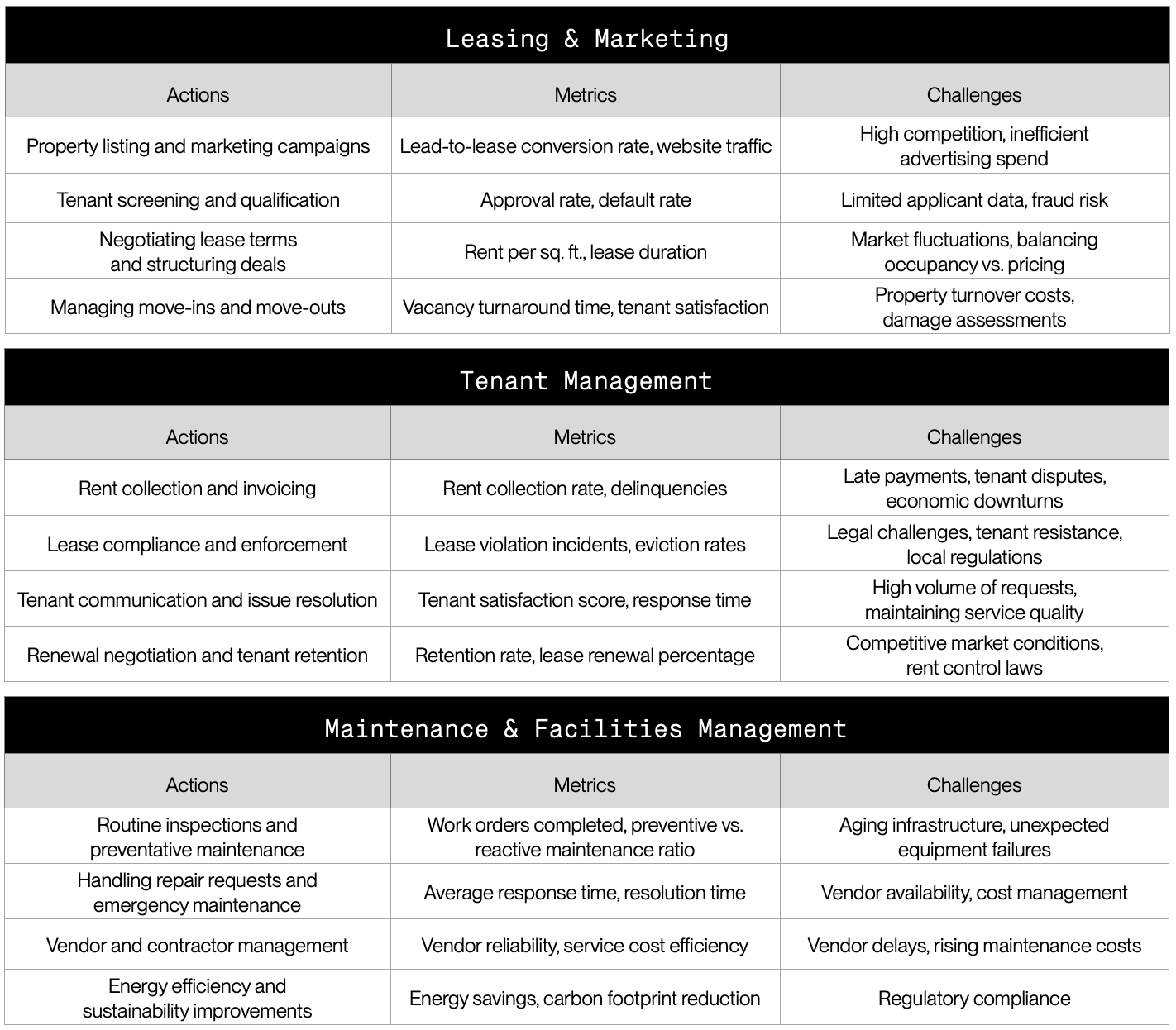

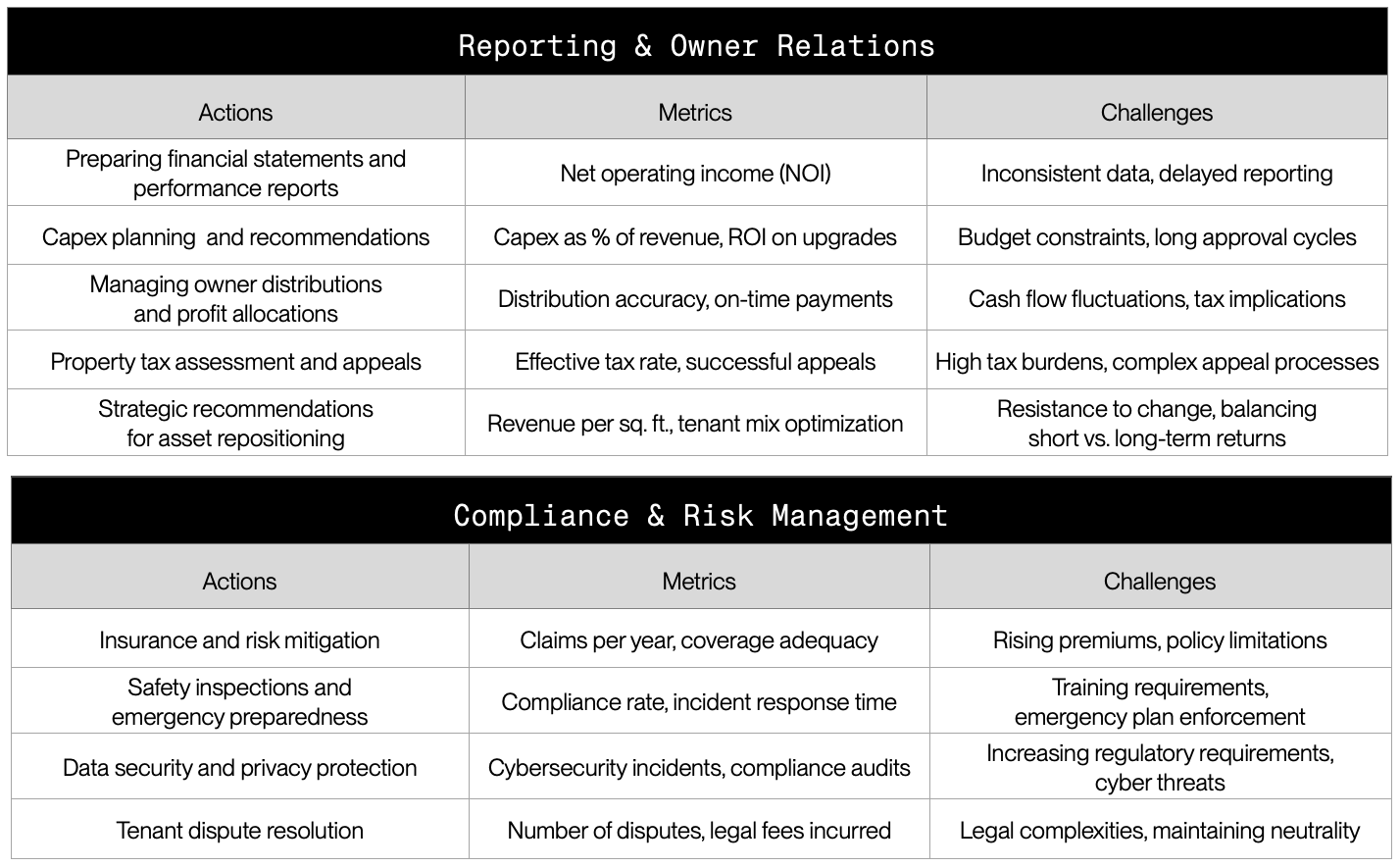

Property Manager Zoom-In

Property management firms are responsible for overseeing the daily operations of real estate assets, ensuring they remain occupied, well-maintained, and profitable. They serve as the critical link between owners/investors and tenants, handling everything from leasing and maintenance to financial reporting and compliance. Their revenue typically comes from management fees (a percentage of gross rental income) and additional service-based fees.

Although real estate brokerage is technically a separate industry, it often goes hand in hand with property management. Many large property management firms have capital markets divisions that handle asset sales, serving as seller’s agents when an owner decides to exit an investment.

Property management companies typically operate under one of two models:

1. Third-Party Management – Managing properties on behalf of institutional or private owners for a fee (e.g., CBRE, Cushman & Wakefield).

2. Owner-Operators – Managing properties they own directly, integrating asset management with property operations (e.g., Greystar, AvalonBay).

The key business drivers for property managers include:

Occupancy & Tenant Retention – Maximizing lease-up rates and renewals to reduce vacancy losses.

Operational Efficiency – Reducing costs related to maintenance, staffing, and vendor contracts.

Regulatory Compliance – Navigating fair housing laws, tenant rights, and local building codes.

Financial Performance – Increasing Net Operating Income (NOI) through rent optimization and expense control.

Workflows

Investor Zoom-In

Investors in commercial real estate range from institutional players such as REITs, pension funds, and private equity firms to high-net-worth individuals and family offices. Their primary objective is to generate returns through capital appreciation, rental income, and portfolio diversification. Depending on their strategy, investors may focus on core, core-plus, value-add, or opportunistic investments, each carrying different levels of risk and return potential.

Most large-scale real estate investment firms have vertically integrated operations, managing everything from acquisitions and asset management to dispositions. Smaller investors may rely on third-party property managers and brokers to operate their assets efficiently.

Key business drivers for investors include:

Market Conditions: Interest rates, supply-demand dynamics, and macroeconomic trends influence investment decisions.

Asset Performance: Metrics like Net Operating Income (NOI), Internal Rate of Return (IRR), and capitalization rates determine the financial viability of properties.

Capital Allocation: Investors must optimize debt and equity structures, balancing leverage and liquidity to maximize returns.

Exit Strategy: Investors assess whether to hold, refinance, or sell properties based on market cycles and projected returns.

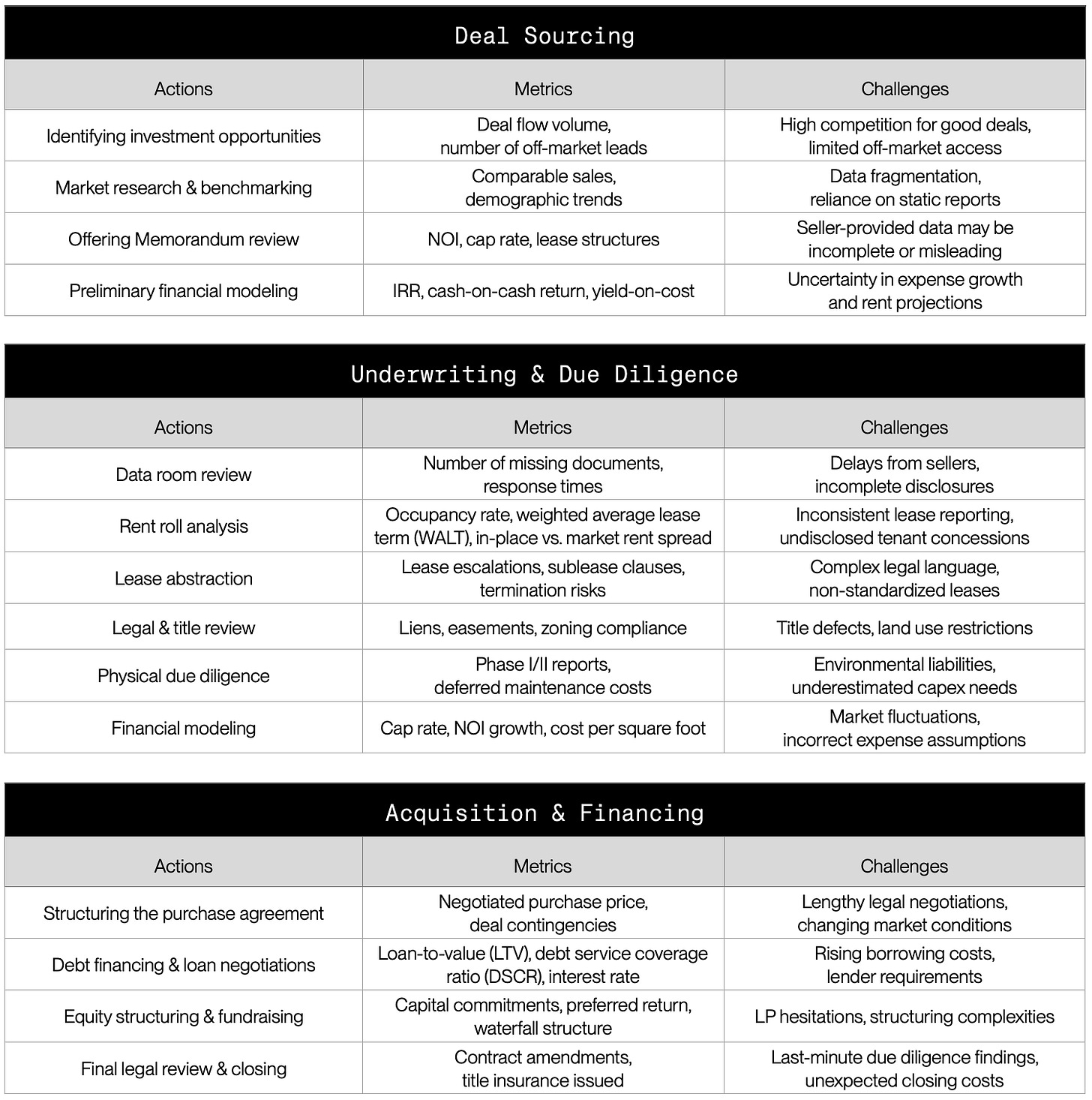

Workflows

III. The Technology

Traditionally, the real estate industry has lagged behind other sectors in adopting technological breakthroughs. While architecture, engineering, and construction have seen advancements in robotics and AI-driven design automation, real estate operations have remained largely resistant to change. The complexity of workflows, reliance on human relationships, and deeply entrenched legacy systems have made the sector slow to modernize.

Nevertheless, artificial intelligence is unlocking new frontiers for developers, property managers, and investors. AI is helping firms process large volumes of unstructured data, predict asset performance with greater accuracy, and automate repetitive workflows - boosting efficiency and returns.

The Real Estate Tech Stack

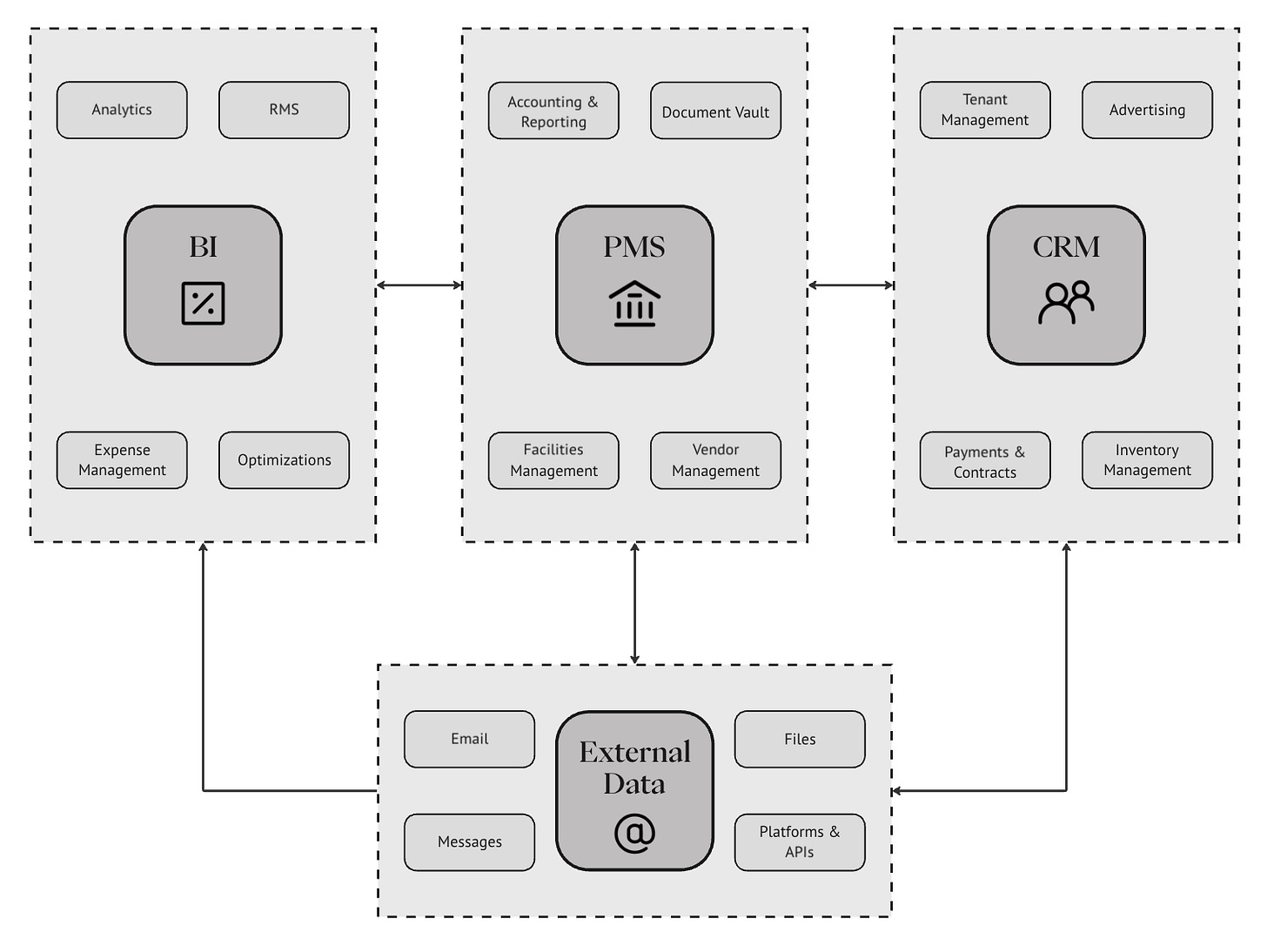

While early real estate software focused on digitizing manual workflows, today’s tech stack is built around five key components:

1. Property Management Systems (PMS) – The Core

2. Customer Relationship Management (CRM) – Advertising, Leasing, and Tenant Management

3. Business Intelligence (BI) – Analytics and Optimization

4. External Data – Communication, General Business Tools, Data and APIs

5. Point Solutions – Specialized Applications

i. Property Management Systems (PMS)

PMS platforms are the backbone of property management, handling leasing, accounting, and reporting. Most large operators run on legacy systems such as Yardi, MRI, Entrata, RealPage, and AppFolio, all of which provide modular functionalities for property operations. Unlike mainstream ERPs such as SAP or Oracle, PMS platforms are built specifically for real estate, often through acquisitions rather than in-house development. These platforms lack flexibility, and their poor API infrastructure makes integrating new solutions a challenge.

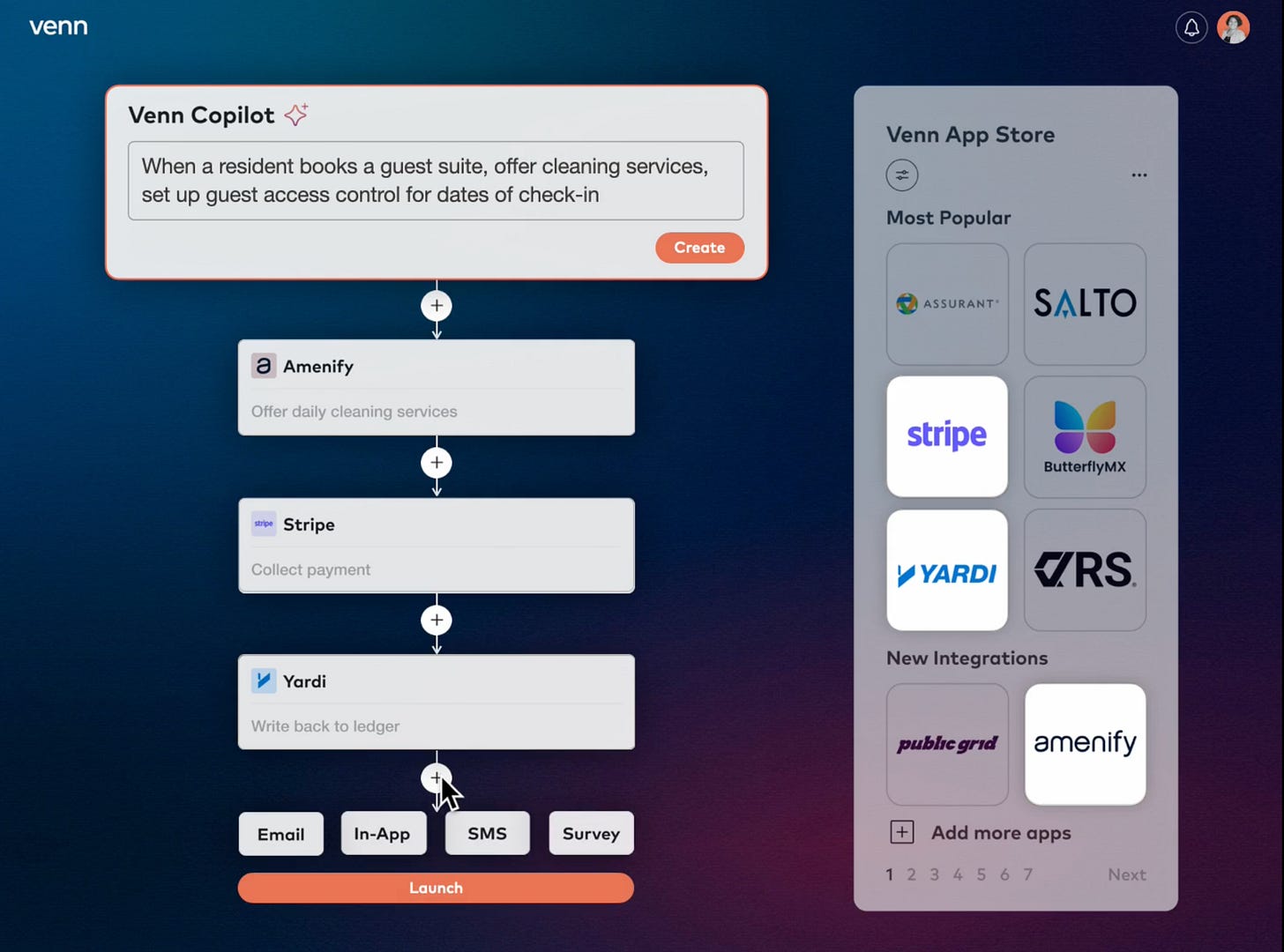

PMS platforms are notoriously difficult to replace due to deep industry lock-in, as investors, lenders, and asset managers rely on standardized reports generated by these systems, making transitions disruptive. Additionally, large accounting teams are trained on PMS workflows, and switching platforms risks operational inefficiencies and financial reporting errors. Further complicating matters, most PMS platforms use outdated SOAP APIs rather than modern SaaS integrations, making data migration and third-party connectivity expensive and time-consuming. To address these challenges, middleware solutions such as Venn and Propexo have emerged, simplifying integrations across multiple PMS platforms and reducing friction for operators looking to adopt new technologies.

ii. Customer Relationship Management (CRM)

While PMS platforms include built-in CRM tools, real estate operators often supplement them with specialized leasing CRMs such as VTS and Funnel. These tools optimize lead generation, tenant communication, and lease conversion rates - capabilities that traditional PMS platforms struggle to execute efficiently.

iii. Business Intelligence (BI)

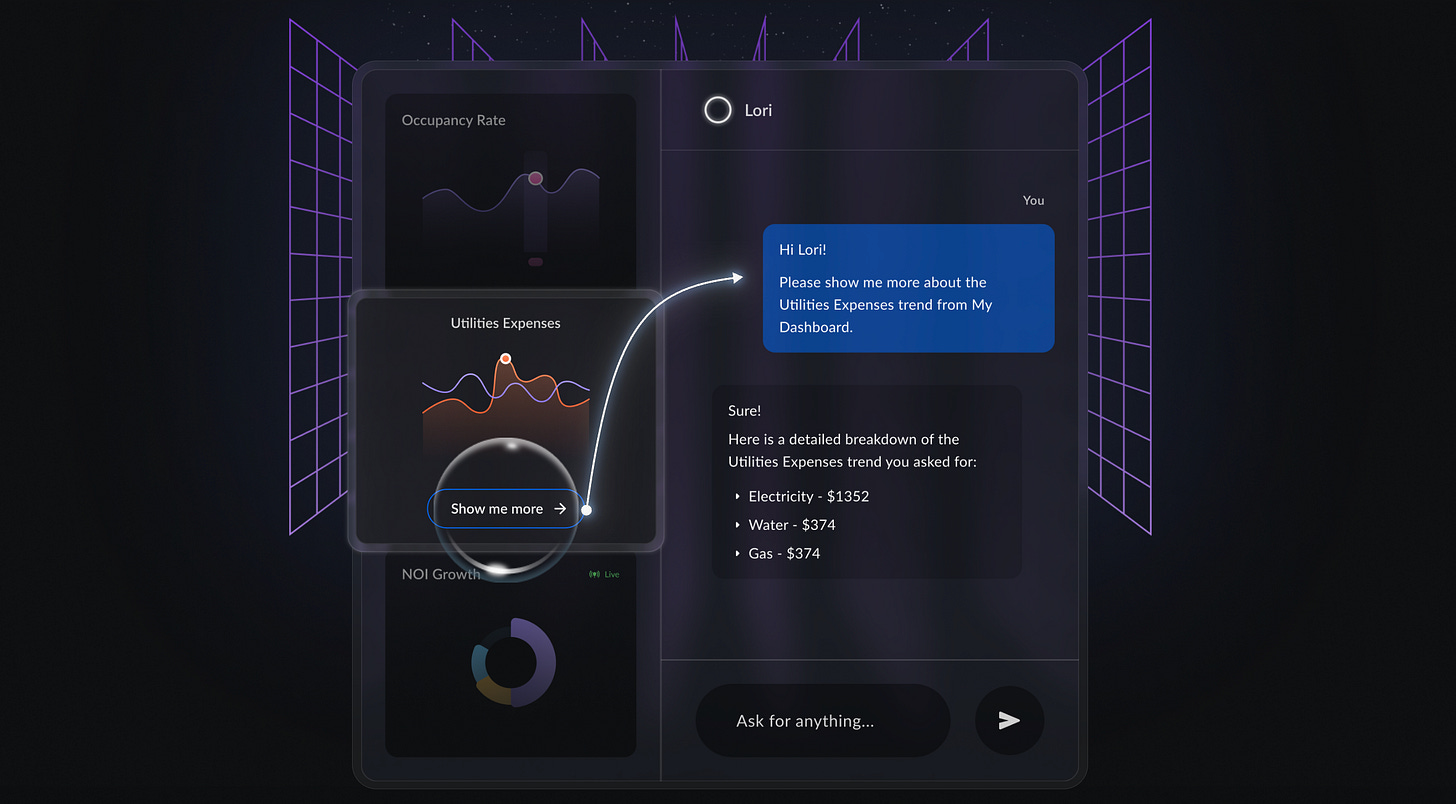

The real estate industry has become increasingly data-driven, but extracting insights from PMS platforms remains a major challenge due to outdated reporting structures and siloed data. This has led to the adoption of BI solutions such as Cherre, VergeSense, and BrainboxAI that enable operators to analyze rent rolls, occupancy trends, and NOI drivers more effectively.

iv. External Data

Beyond PMS and CRM, real estate operators rely on external platforms such as Microsoft Office, Google Drive, and CoStar for market intelligence, financial modeling, and document management. However, these tools often operate in isolation, making data synchronization a challenge.

v. Point Solutions

Over the past decade, venture-backed point solutions have emerged to improve specific leasing, maintenance, and asset management workflows. These tools often outperform built-in PMS functions but require complex integrations. While these solutions offer superior functionality, the cost of integrating multiple point solutions into a PMS often leads to tech fatigue among real estate operators.

Build vs Buy

How ROI is Measured

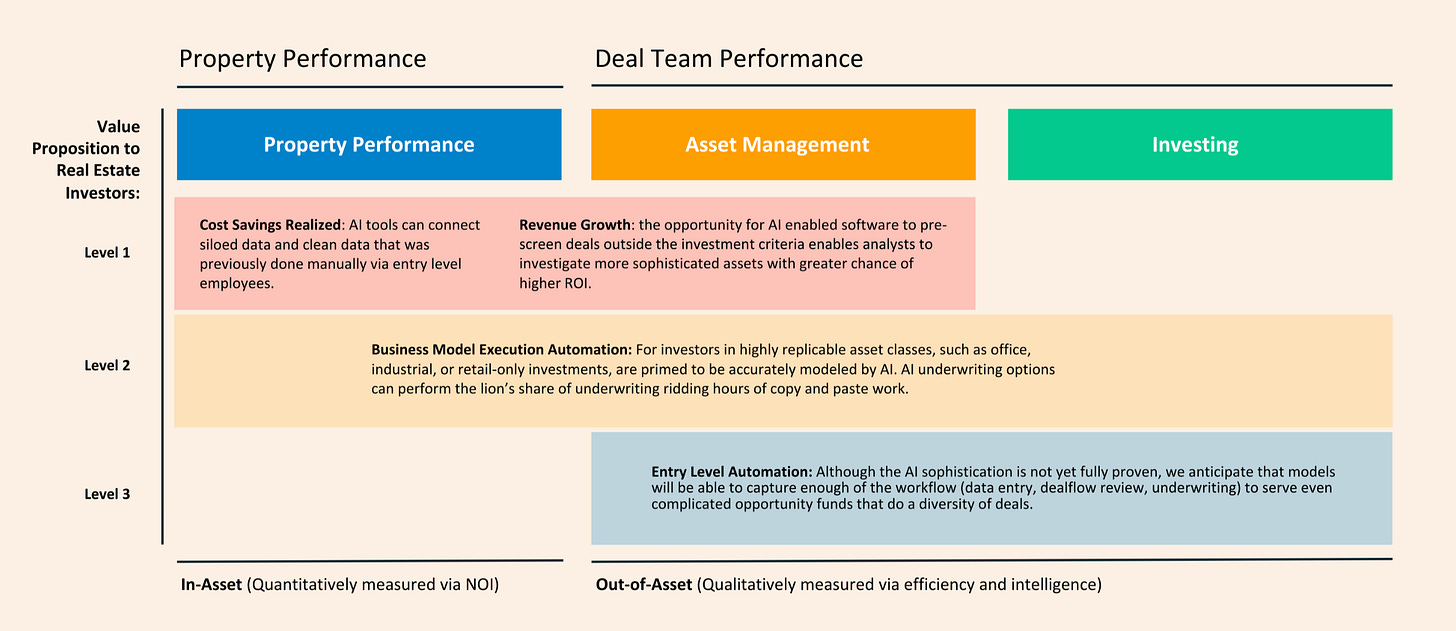

Alpaca VC provided a brilliant analysis of real estate technology through the lens of in-asset vs. out-of-asset solutions. This distinction highlights how technology is deployed across different parts of the industry and where it generates the most impact.

In-Asset Solutions directly influence a property’s Net Operating Income (NOI) by reducing costs or increasing revenue. These include AI-driven maintenance automation, smart energy management, dynamic rent pricing models, and surveillance analytics. Since these tools generate clear financial returns, they tend to be more easily justifiable from an investment perspective.

Out-of-Asset Solutions focus on improving the efficiency of the deal team, helping investors and developers optimize speed and decision-making. These tools enhance workflows in underwriting, financial modeling, legal documentation, and market analysis. AI-powered lease abstraction, underwriting automation, CRM optimization, and investment dashboards fall under this category. While these solutions don’t directly impact NOI, they reduce labor costs and improve capital allocation.

This framework is critical for understanding where AI and automation will have the biggest impact. In-asset solutions tend to be more defensible and ROI-driven, while out-of-asset solutions often require behavioral change and adoption from institutional players. The latter is harder to scale but can significantly improve decision-making efficiency.

AI-First Real Estate Firms

A new wave of AI-first real estate investors and operators is emerging, built from the ground up with technology at their core. Unlike traditional firms that integrate AI tools incrementally, these companies are designed around automation from day one, leveraging AI for acquisitions, property management and operations.

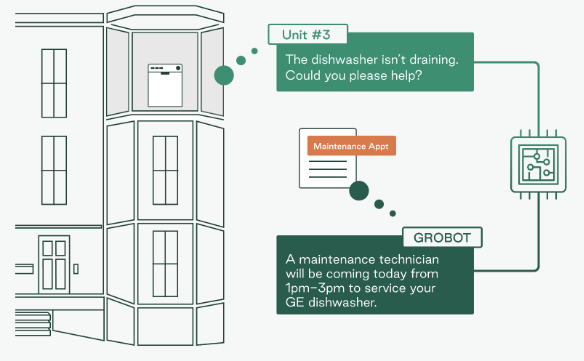

Groma is a REIT based in Boston, MA, focused on acquiring, renovating and managing small multifamily buildings (2-20 units). Using OpenAI’s platform, they have built a suite of AI tools collectively called Grobot, fed with information from their manuals and external data sources. Grobot’s workflows are tailored towards major aspects of Groma’s acquisitions and property management, automating time-consuming tasks such as financial modeling and tenant communication.

Firms like Alpaca Real Estate (ARE) represent another facet of this transformation. Alpaca VC, a leading investor in proptech, launched ARE to create a real estate private equity platform powered by technology. By leveraging Alpaca VC’s extensive research and continuously updated market map, ARE is uniquely positioned to identify and implement the most effective AI-driven real estate strategies.

Some established industry giants like CBRE and JLL are embedding AI into their existing workflows, as well as rolling them into client offerings. CBRE’s Ellis AI leverages the firm’s vast data repository to accelerate research, automate supply chain analysis, and power digital assistants for leasing, asset management, and sales. Meanwhile, JLL’s Falcon provides a secure, AI-enabled software suite designed to support investors, occupiers, and real estate professionals with real-time insights, lease abstraction, and property marketing automation.

Early adopters of AI-first strategies are beginning to accumulate proprietary datasets that give them a long-term advantage. As these firms refine their models and optimize workflows, they are poised to operate with lower costs, higher efficiency, and superior risk-adjusted returns compared to traditional competitors. While AI integration in real estate is still in its early stages, the firms building AI-native infrastructure today are setting a new standard for how properties are acquired, managed, and optimized in the future.

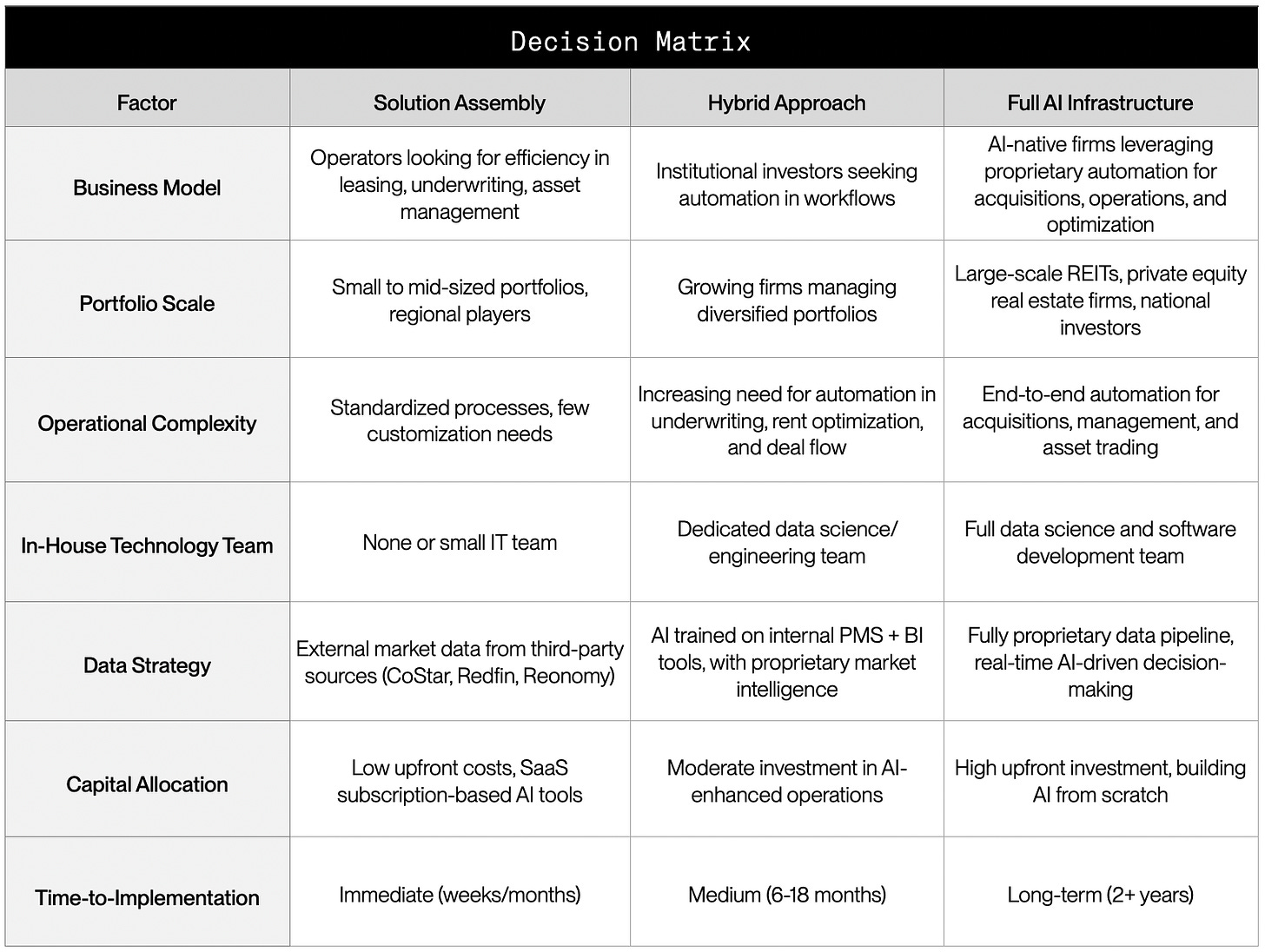

Decision Matrix

Real estate firms looking to adopt AI face a fundamental question: should they assemble off-the-shelf solutions or build a proprietary AI infrastructure? While early adopters have experimented with AI-enhanced tools, firms today have multiple strategic paths—integrating AI into existing workflows (solution assembly), layering AI atop PMS and BI tools (hybrid approach), or developing a full AI-native operating model (full-stack infrastructure). Each path comes with trade-offs in cost, complexity, and long-term competitive advantage.

Solution Compass

i. Automated Sourcing, Underwriting & Investment Decision-Making

AI is transforming real estate investing by streamlining deal sourcing, underwriting, and valuation. Instead of relying on slow, manual due diligence, investors can now leverage:

Automated deal sourcing: scrape listings, analyze comps, and flag high-potential opportunities through tools like LandTech, Proprise and Reonomy.

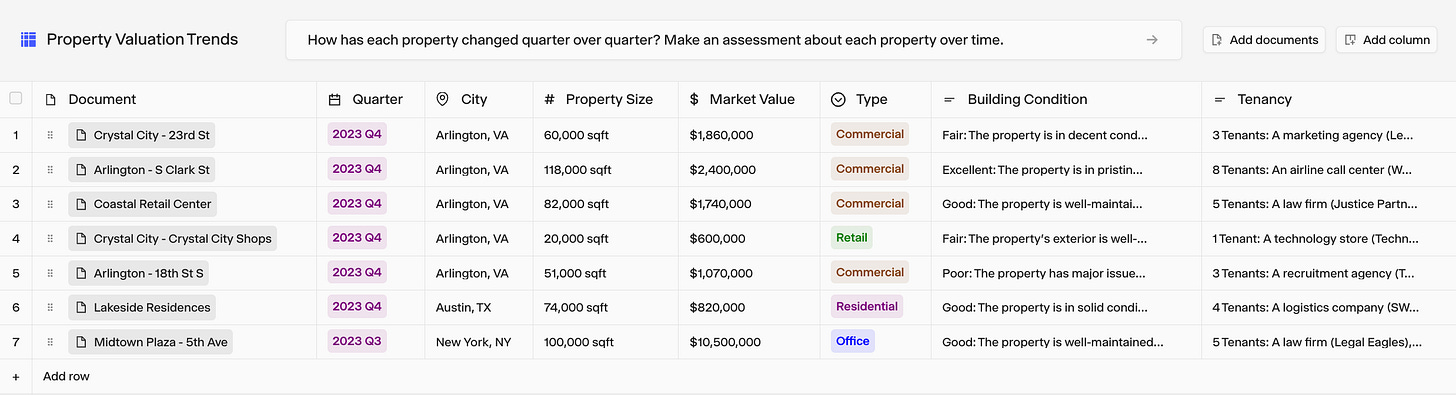

Predictive underwriting models: Companies like Hebbia, ArcherRE and SkylineAI integrate vast data sources to create automated valuation models.

AI-powered risk assessment: Real estate investors are increasingly using AI to predict market shifts and asset risks with greater accuracy than traditional modeling with the likes of CAPE Analytics, IntellCRE and Geolava.

The result? Faster transactions, better pricing decisions, and data-driven investment strategies.

ii. AI-Powered Property & Tenant Management

The way buildings are managed and tenants interact with properties is undergoing rapid AI-driven transformation. Key innovations include:

AI leasing assistants: Chatbots like EliseAI, Funnel and Zuma handle tenant inquiries, schedule showings, and process applications 24/7.

Automated maintenance management: AI agents such as HappyCo, Mezo and Credia manage scheduling, vendor communications and inventory management.

Smart Building Operations: Companies like Brainbox AI, Noda, and VergeSense optimize energy efficiency, occupancy tracking, and operational workflows using AI-driven automation and real-time analytics.

These innovations reduce operational inefficiencies, minimize vacancies, and enhance the tenant experience - ultimately improving NOI and asset value.

iii. Security, Compliance & Operational Intelligence

AI is enhancing real estate security, financial oversight, and operational intelligence, allowing owners to reduce risk and improve asset performance.

AI-Powered Surveillance & Risk Detection: Companies like Cobalt AI, Anodet, and DwellWell use AI-driven anomaly detection, computer vision, and sensor data to monitor properties, detect unauthorized access, and reduce liability risks.

AI for Asset & Portfolio Management: Muvan AI acts as a copilot helping asset managers synthesize portfolio data, optimize capital allocation, and generate performance reports in real time.

AI for Financial & Compliance Automation: ProperAI streamlines real estate accounting, lease abstraction, and compliance auditing, reducing manual errors and regulatory risks.

Opportunities for Startups

The next generation of real estate technology startups has the chance to redefine how real estate professionals operate - whether by replacing entrenched but outdated platforms, unlocking new data-driven insights, or automating previously manual workflows.

High-Value Opportunity Spaces

i. Building a New PMS System

Most PMS platforms were designed decades ago and have accumulated layers of complexity due to acquisitions rather than intentional, AI-driven innovation. A new AI-first PMS could integrate automated accounting, AI-powered maintenance workflows, dynamic leasing optimization, and seamless third-party integrations - without the API headaches that come with traditional platforms. This is a high-risk, high-reward opportunity, as breaking PMS incumbents’ stranglehold on the industry is difficult, but the prize is enormous. An example of someone building in this space is Ender.

ii. AI for Real Estate Accounting

Accounting remains one of the most manual, error-prone aspects of real estate management. Most firms still rely on disjointed spreadsheets and legacy PMS tools to manage books, reconcile expenses, and generate financial statements. Startups like ProperAI are beginning to apply AI to automate real estate accounting, lease abstraction, and financial compliance. However, there is still ample opportunity to develop AI-powered accounting copilots that can handle rent rolls, expense categorization, and tax optimization with minimal human input.

iii. Domain-Specific Property Law LLMs

Legal review is a critical yet slow-moving component of real estate transactions, particularly when it comes to lease abstraction, zoning compliance, and contract negotiation. General-purpose LLMs struggle with the complexity and specificity of property law, making real estate legal tech a prime area for domain-specific LLMs that can read, interpret, and summarize legal documents with high accuracy. These AI models could help developers, investors, and asset managers flag risks in lease agreements, compare zoning regulations, and ensure compliance with local laws, reducing legal costs and accelerating deal execution.

IV. The Market

Industry Adoption Trends

According to Thesis Driven’s analysis of public real estate company earnings calls, AI and automation are becoming central to industry conversations - but with a clear focus on cost reduction and operational efficiency rather than revenue generation.

Most firms see AI as a tool for streamlining property management, centralizing operations, and reducing labor costs. Equity Residential is rolling out AI leasing assistants to automate tenant interactions, while MAA has fully integrated SmartRent to drive NOI growth. AvalonBay continues deploying AvalonConnect, its proprietary tech platform for centralizing leasing and management.

A growing number of large REITs and investors are building their own AI-powered tech stacks, reducing reliance on third-party solutions. Welltower and Blackstone have both invested heavily in proprietary technology, using AI for portfolio management and investment decision-making. Underwriting and investment analytics are also gaining traction, with Essex Property Trust leveraging real-time migration data and Blackstone using AI to refine its macro strategy.

While most firms still frame AI adoption around cost-cutting, the next phase of innovation will likely focus on tenant experience, revenue growth, and market intelligence, as firms like Welltower and Prologis begin leveraging AI beyond internal efficiencies.

Partnerships

As AI adoption accelerates across real estate, firms are partnering with startups, acquiring technology companies, and integrating AI into their core operations.

i. Property Managers Partnering with Startups

↳ Greystar partnering with EliseAI for AI-driven prospect engagement

↳ RPM Living elevates customer service with HappyCo’s call management

↳ Blackstone uses PRODA for faster, smarter portfolio analysis and insights

ii. Investors Partnering with Startups

↳ Bridge Investment Group takes workflows to the cloud with Dealpath

↳ Brookfield partners with VTS to streamline asset management workflows

iii. Incumbents Building In-House AI

↳ CBRE’s Ellis AI powers leasing, supply chain analysis, and digital assistants

↳ JLL Falcon provides AI-driven insights for investment decisions

iv. Strategic M&A

↳ Altus Group acquires Reonomy for $250 million

↳ Appfolio acquires conversational AI startup Dynasty for $60 million

↳ JLL acquires investment analysis startup Skyline AI for an undisclosed amount

Pricing and Demand Drivers

AI adoption in real estate is accelerating as firms seek to reduce costs, improve decision-making, and stay competitive. AI-powered solutions automate leasing, underwriting, and asset management, freeing teams from time-intensive manual tasks and allowing them to focus on higher-value strategic work. Cost efficiency is a major driver, as AI reduces overhead by streamlining operations and centralizing workflows. These tools also enhance risk management and portfolio optimization, helping investors make data-driven decisions while ensuring compliance with complex regulatory requirements. Finally, as institutional players integrate AI at scale, adopting these technologies is becoming a competitive necessity, with firms that fail to embrace AI facing increasing pressure to keep pace in an evolving market.

Pricing Models

i. SaaS License (Flat Subscription) – Companies pay a fixed fee per property, unit, or portfolio

ii. Usage-Based Pricing (Transaction-Based) – Costs scale with usage, often tied to deal volume or property revenue.

iii. Custom Enterprise Solutions (Bespoke AI Infrastructure) – Large real estate firms license custom-built AI platforms.

As AI adoption grows, hybrid pricing models (mixing SaaS + usage-based fees) are also emerging, allowing firms to pay based on both scale and performance.

Labor Market Size

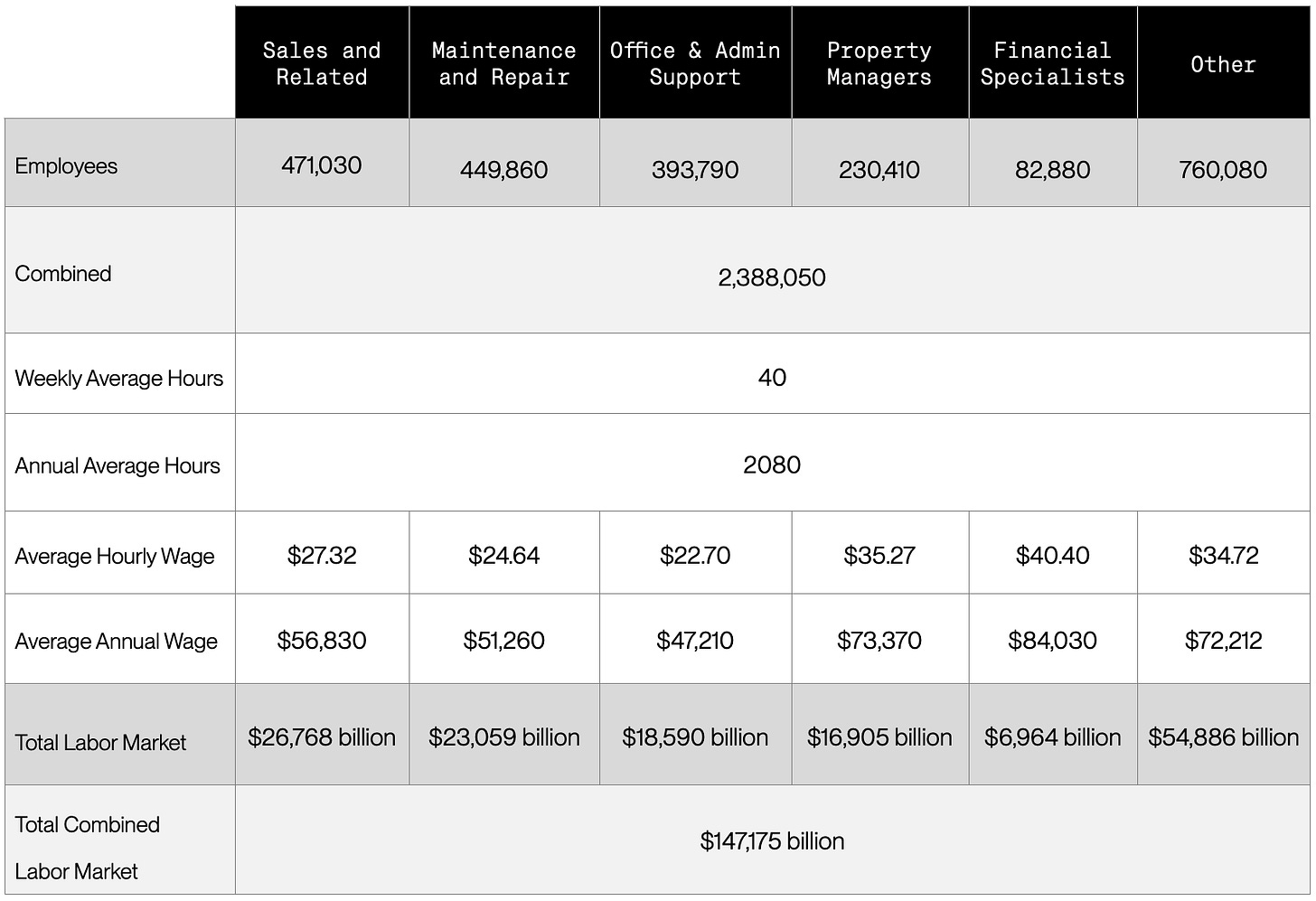

The US real estate industry employs over 2.3 million professionals, with a total labor market of $147 billion in annual wages. AI won’t replace these roles but will streamline workflows, reduce manual tasks, and enhance decision-making. Property managers can handle larger portfolios with fewer resources, investors will benefit from faster underwriting and risk modeling, and back-office tasks like accounting and compliance will become more automated.

As AI adoption grows, labor productivity will increase, enabling firms to scale efficiently and drive higher returns. Companies that embrace AI will gain a competitive edge through cost savings and enhanced operational efficiency.

The real estate software market is estimated at $12.44 billion in 2024, dominated by PMS, CRM, and analytics platforms. AI-driven solutions are expected to significantly expand this market, with increasing demand for automated underwriting, predictive maintenance, and market forecasting tools.

As firms transition from legacy systems to AI-enhanced software stacks, spending on intelligent data platforms and AI agents will surge. Institutional investors and large property managers are leading this shift, making AI an essential part of real estate’s digital transformation.

V. The Innovators

As artificial intelligence reshapes industries, the real estate sector is undergoing a fundamental transformation. A new wave of AI-driven companies is redefining how properties are sourced, managed, and transacted - streamlining everything from investment underwriting to tenant relations and predictive maintenance. The following companies are some of the favorite picks from our analysis.

EliseAI

The leasing OG

HQ: 🇺🇸 New York, NY

Founded: 2017

Website: eliseai.com

Headcount: 150

Total Raised: $141,928,985

EliseAI is transforming property management with its AI-powered leasing and tenant communication tools. Its AI leasing assistant handles inquiries, schedules tours, and processes applications, while its resident assistant manages maintenance requests, lease renewals, and payment reminders. Founded by Minna Song and Tony Stoyanov in 2017, EliseAI has grown into one of the most widely adopted AI platforms in residential real estate, serving 70% of the top 50 U.S. rental housing operators. Unlike competitors that rely on third-party data, EliseAI trains its AI models exclusively on proprietary data, ensuring control over accuracy and compliance.

Founders: Minna Song, Stoyan Stoyanov

Partners and Customers: Greystar, AvalonBay, Equity Residential, Bozzuto

Select Investors: Sapphire Ventures, Point72 Ventures, Navitas Capital

Permitflow

TurboTax for construction permitting

HQ: 🇺🇸 New York, NY

Founded: 2021

Website: permitflow.com

Headcount: 79

Total Raised: $36,500,000

PermitFlow is revolutionizing construction permitting by automating one of the most time-consuming and error-prone aspects of real estate development. The platform provides an end-to-end workflow solution that simplifies everything from initial research and application preparation to submission, monitoring, and municipal coordination. By streamlining the process, PermitFlow helps GC’s and developers navigate complex permitting requirements with greater speed and predictability, reducing project delays and unexpected costs. With LLMs, the company aims to enhance its ability to interpret municipal requirements, guide users through the submission process, and reduce the back-and-forth inefficiencies that typically plague permitting workflows.

Founders: Francis Thumpasery, Samuel Lam

Partners and Customers: Lennar, Cushman & Wakefield, Brookfield Properties

Select Investors: Y Combinator, Felicis, Kleiner Perkins, Altos Ventures

BrainBox AI

The world’s first AI building engineer

HQ: 🇨🇦 Montreal, Canada

Founded: 2017

Website: brainboxai.com

Headcount: 190

Total Raised: $75,081,788

BrainBox AI is redefining energy efficiency in commercial real estate with AI-driven building management solutions. Its flagship technology, ARIA, was recently recognized by TIME as one of the best inventions of 2024 for its impact on sustainability. Leveraging generative AI, ARIA functions as a virtual building engineer, optimizing HVAC energy use in real-time and significantly reducing carbon emissions. BrainBox AI’s suite of tools has demonstrated the ability to cut energy costs by up to 25% and lower emissions by 40%. The company’s success in AI-driven energy optimization led to its acquisition by Trane Technologies, an Irish HVAC giant, in January 2025.

Founders: Angelos Vlasopoulos, Jean-Simon Venne, John Cammett, Sean Neely

Partners and Customers: Dollar Tree, Nordstrom, SAIL

Select Investors: Export Development Canada, Amazon, ABB, Esplanade Ventures

Lev

AI-powered CRE financing

HQ: 🇺🇸 New York, NY

Founded: 2021

Website: lev.co

Headcount: 95

Total Raised: $214,782,994

Lev is transforming commercial real estate financing by leveraging AI to streamline deal sourcing, underwriting, and loan execution. Traditionally, CRE financing has been slow and manual, with fragmented processes requiring extensive paperwork and lender relationships. Lev’s digital platform replaces these inefficiencies with AI-driven automation, matching sponsors with lenders, optimizing deal structures, and expediting loan closings. The company recently launched Lev Pipeline Management, a tool that helps acquisition teams track and manage potential deals. Integrated with Lev’s broader financing platform, it allows sponsors to transition properties from initial evaluation to financing in one click. Additional features, such as real-time loan sizing and lender-matching algorithms, provide a seamless capital markets workflow.

Founders: Sammy Greenwall, Yaakov James Zar

Partners and Customers: Lexington Partners, Alturas Capital Partners, Nomad

Select Investors: NFX, Canaan Partners, JLL Spark, Animo Ventures

VTS

The modern OS for CRE

HQ: 🇺🇸 New York, NY

Founded: 2012

Website: vts.com

Headcount: 667

Total Raised: $462,360,000

VTS is transforming CRE by centralizing leasing, marketing, and property management on a single platform. Its AI-driven tools enhance deal execution, tenant engagement, and market intelligence for major landlords, brokers, and investors. Leveraging billions of data points, VTS applies proprietary machine learning models to predict demand, optimize leasing, and streamline operations. Its VODI Index provides real-time insights, while AI-driven automation improves workflows like service requests and preventative maintenance. Looking ahead, VTS is expanding into generative AI for predictive analytics, tenant sentiment analysis, and underwriting. While AI is core to its strategy, the company emphasizes that industry-wide transformation depends on better data governance and adoption by professionals.

Founders: Brandon Weber, Donald DeSantis, Karl Baum, Niall Smart, Nicholas Romito, Ryan Masiello

Partners and Customers: Blackstone, Brookfield Properties, JLL, CBRE

Select Investors: Bessemer, BoxGroup, Insight Partners, Fifth Wall, 500 Global

Venn

The Zapier of real estate

HQ: 🇺🇸 New York, NY

Founded: 2016

Website: venn.city

Headcount: 113

Total Raised: $100,000,000

Venn is redefining how property owners, managers, and residents interact by serving as the middle layer, seamlessly integrating multiple property management tools into a unified, automated ecosystem. For property teams, Venn eliminates fragmented tech stacks, automating leasing, move-ins, renewals, and maintenance workflows to reduce inefficiencies and cut operational costs. Owners benefit from data-driven insights and revenue optimization, while marketing teams leverage white-labeled branding to enhance resident engagement. On the resident side, Venn offers an all-in-one app for rent payments, service requests, and smart access, while fostering a sense of community through neighbor connections and engagement rewards.

Founders: Or Bokobza, Chen Avni

Partners and Customers: Bozzuto, Mac Properties, M. Shapiro, Barbican

Select Investors: Group 11, Hamilton Lane, Pitango VC, Eyal Gura, Bridges Israel

Henry

Deal decks done in minutes

HQ: 🇺🇸 New York, NY

Founded: 2024

Website: henry.ai

Headcount: 3

Total Raised: $4,000,000

Henry is an AI-powered copilot designed to streamline CRE brokerage workflows, automating the creation of OM’s, decks, leasing fliers and other marketing materials. By integrating a brokerage’s internal data with external market sources, Henry enables brokers to generate polished materials in minutes instead of weeks. With major national brokerages already leveraging its technology, Henry is redefining efficiency in the $20 trillion CRE industry - allowing brokers to spend less time on manual tasks and more time on closing deals.

Founders: Adam Pratt, Sammy Greenwall

Partners and Customers: -

Select Investors: RXR, Singularity Capital, Pioneer Fund, Yahya Mokhtarzada

We expect AI adoption in real estate to accelerate as technology matures and integration barriers decrease. AI-driven solutions are already streamlining workflows in property management, leasing, underwriting, and asset optimization, allowing firms to allocate resources more strategically. As efficiency gains compound, AI will become an essential component of real estate operations, driving measurable improvements in deal execution, tenant engagement, and portfolio performance across the industry.